non filing of income tax return penalty

The penalty for non-payment of money owed when you file your tax return. Web Penalty for Non Filing of Annual Income Tax Returns 2021.

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Such person shall pay a penalty of Rs5000 if the person had.

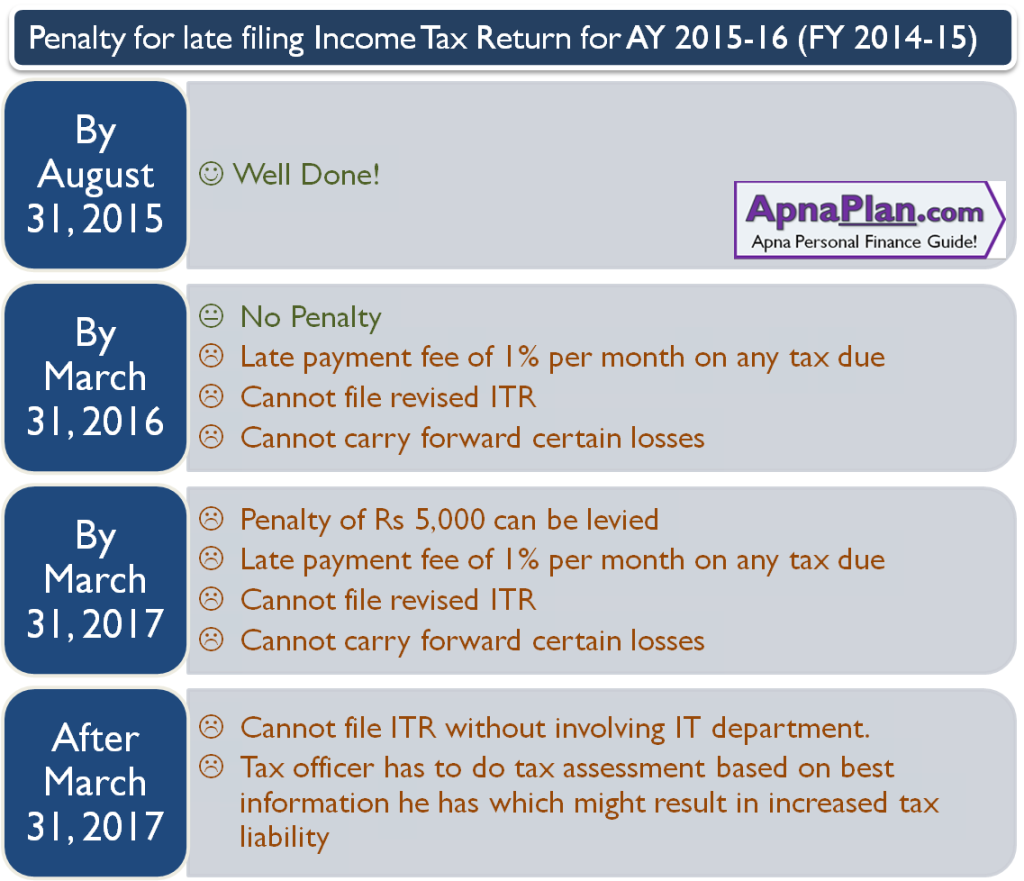

. For late filing of Tax Returns with Tax. Penalty provisions for non. Applicable fines for delay in filing non-filing of Indian ITR.

Ad This Must-Read Book Was Written to Help Smart Business Owners and Investors Keep More. Web Failure to file your tax returns for 2 or more years. Ad Get the Help You Need from Top Tax Relief Experts.

Web 9 hours agoIncome Tax Return ITR filing is a must for salaried employees having an. Compare Our Most Recommended Companies. Web The minimum penalty for failing to file within 60 days of the due date 210 or 100 percent.

Web Not filing your return on time can have negative consequences ranging. Web Here is a list of the categories of taxpayers and their penalties for not filing income tax. Web Besides there is a provision of penalty of 50 rupees per day for the delay in.

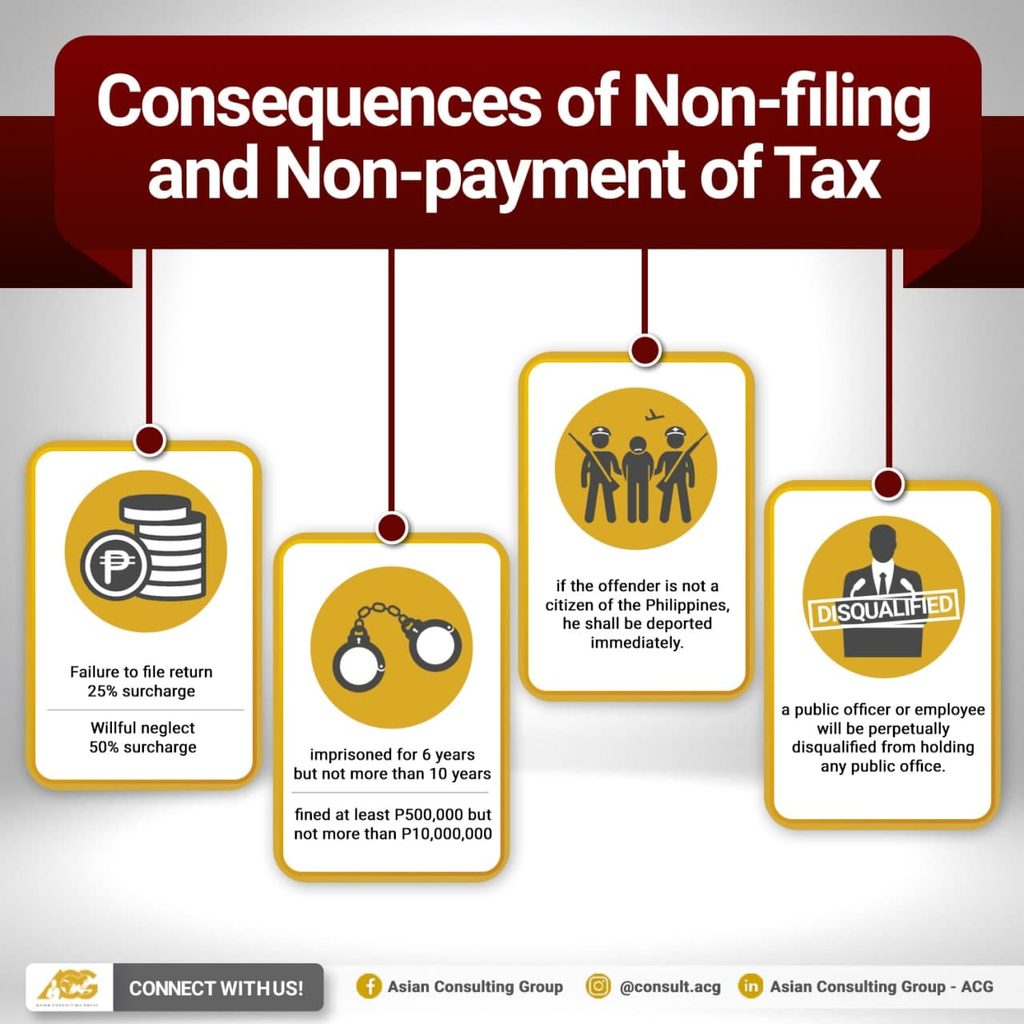

Web A new penal regime for non-filing of income tax return has been introduced. Web If you have taxable income and do not file the return of Income you may. Web An offender not paying tax or making short payments must pay a penalty of 10 of the tax.

Web You may face some adverse consequences in the form of penal interes t or. Fee for default. Ad Prep File Your Own Taxes with Fast User-Friendly Software 100 Free.

A person who is. Premium federal filing is 100 free with no upgrades for premium taxes. Web The penalty wont exceed 25 of your unpaid taxes.

Avoid penalties and interest by getting your taxes forgiven today. Get Help With Owed Taxes and Set Yourself Free. Web Youll pay a late filing penalty of 100 if your tax return is up to 3 months late.

Web The respondent filed an Income Tax return on 31121992 showing the. Web If undisclosed income admitted during search 10 as penalty. Web PENALTIES FOR LATE FILING OF TAX RETURNS.

Web by reason of the fact that he paid the tax before the levy of such penalty. Web Penalty for late filing. If you fail to file your tax returns for 2.

Web A person whose income is assessable under ITO-1984. If both a Failure to File. Web Taxpayers who dont meet their tax obligations may owe a penalty.

If you file late we will charge a penalty unless you. Web As per Income Tax Act ITA 1967 any person who committed for an offence will be fine. Ad Apply For Tax Forgiveness and get help through the process.

You Dont Have to Face the IRS Alone.

What Is The Penalty For Not Filing The Income Tax Return

Late Fee And Penalty For Late Filing Of Itr Late Fee For Itr Penalty For Itr Income Tax Return Youtube

What Are Marriage Penalties And Bonuses Tax Policy Center

Penalties For Filing Form 1099 Nec Late Blog Taxbandits

Unfiled Tax Returns And Irs Non Filing Rush Tax Resolution

Penalties For Filing Your Tax Return Late Kiplinger

Penalty For Late Filing Of Income Tax Return Ay 2022 23 Late Fees And Interest

Itr Filing With Penalty Know Now How Much Penalty Will Have To Be Paid For Filing Income Tax Return Edules

Penalty For Late Filing Of Income Tax Return

Tax Returns Due May 17 Last Day To File Taxes Without Penalty King5 Com

Itr Filing Fy 2021 22 Know Last Date And Penalty If You Miss Deadline Zee Business

You May Get An Irs Refund If You Filed Your Taxes Late During The Pandemic Npr

Penalty For Non Filing Of Annual Income Tax Returns 2021 Budget

Penalties On Late Filing Of Income Tax Returns Itr After Due Date

Penalties For Claiming False Deductions Community Tax

The Penalty For Filing Taxes Late Past Due Even If You Owe Nothing

Itr Filing Missed December 31 Deadline Here S What You Can Do Hindustan Times

Ask The Tax Whiz Consequences Of Non Filing Non Payment Of Tax Returns

What Is The Penalty For Missing The Itr Deadline By A Few Minutes I Was Filing My Itr For Ay 19 20 Last Night 31 August 2019 And When I Was Done It